The Future of Microcredit and Social Business

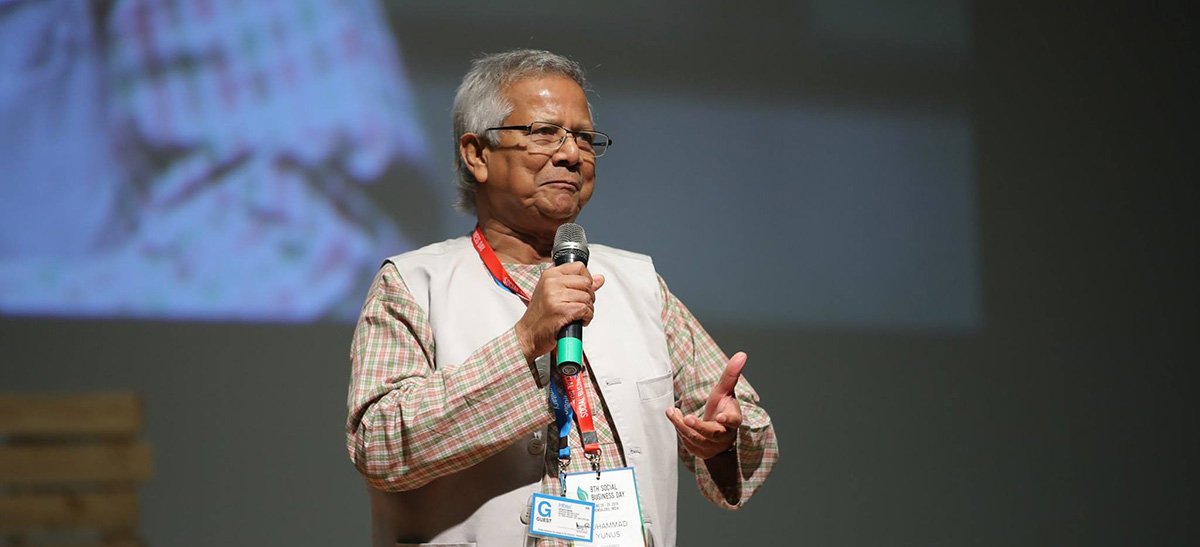

Indian Newspaper The Financial Express Reporter Kumar Sharma’s Interview with Professor Muhammad Yunus on

The Future of Microcredit and Social Business

Muhammad Yunus

Q1: The question that many in the field seem to have is how do you see this pan out in the new era ravaged by the pandemic, which has not made it safe and conducive for holding group meetings, so how will this social collateral be established in the new environment?

Muhammad Yunus: The pandemic is a new phenomenon causing a massive dislocation in poor people’s lives. However this is not the only disaster that microcredit borrowers have had to face so far. Bangladesh is known as a country of disasters. The situation gets worse because of global warming. Every year some parts of the country go under water because of local floods. Additionally there are national disasters of floods at regular intervals. Some times the level of flood water goes over the roof top of the houses. In one flood, boats and steamers became modes of transportation in Dhaka city. Cyclones and tidal waves are regular visitors in the southern part of the country. These are more serious than the pandemic. Nothing escapes these disasters — houses, animals, material possessions, lives and so on.

Microcredit has learned to survive financially and organisationally through these regular disasters. If it could not deal with these, microcredit would have been wiped off long back. Just go through the history of disasters and microcredit in Bangladesh and then you’ll see the detailed institutional safety mechanisms built into these programmes.

Q2: The microlending model also works based on frequent meetings – weekly or monthly – collecting and exchanging cash and also attending group trainings and for most microfinance institutions unlike the other structure of finance, the economies of scale came from collections made at one location. How will this model change? For instance, will it become more expensive as representatives from the microfinance institutions will have to each member instead of holding group meetings?

Muhammad Yunus: These are matters of experimentation. Many people will try many different ways to improve the early versions of microcredit. Nobody expects microcredit to remain unchanged over time.

A good example is the recent experiences of Grameen America. Forced by the pandemic they have done something nobody thought they would ever do. To cope with the pandemic they introduced virtual centre meetings with digital payments. All their 3,000 centres now hold their centre meetings virtually. All branches are cashless branches. Nobody has to arrive at a specific location to do business with Grameen America. Borrowers attend their virtual centre meetings from wherever they are, from their kitchens, from markets, from cars, from street corners. The Grameen America staff do not have to travel to a certain place to attend any centre meeting. Head office executives and branch managers can drop into any centre meeting at any time and participate in the discussions of the borrowers. No travel plans, no itinerary are needed, no travel cost is incurred. Repayment has gone back to over 99% as before.

Grameen America has 24 branches in 14 major US cities, which lend out over half a billion dollars a year. Lending and repayment went down drastically in the first six months when 52 of their borrowers died of Covid-19. Then with the introduction of virtual system it returned to pre-pandemic levels. (Google Grameen America for more information).

Grameen America is now busy with their expansion plans, rather than worrying about damages caused by the pandemic. It went ahead confidently with opening a new branch during the pandemic, in the poverty torn part of Chicago. Grameen America did not have any presence in the city before. This was the first ever branch in the city. Due to the pandemic they decided to take a bold step. They decided to create it entirely as a virtual branch. They even had a virtual opening ceremony. Staff never physically met with any of the interested persons who want to form a group. All negotiations, training, and centre and group meetings took place virtually. The branch is confident to do as well as the branches which were created before it with physical interactions with unknown people to earn their trust.

Technically you can run this virtual branch in Chicago from anywhere in the world; no branch staff has to be in Chicago. Learning from Chicago, Grameen America is now considering to abolish physical offices for all branches. Physical offices don't make sense any more.

Q3: If post the current pandemic we do not return to the old way of engagement then historically the credit losses of less than 1 per cent that most microlending institutions used to enjoy and feel proud about may get disturbed because without frequent meetings and peer group pressure will it become like any other unsecured lending business, which comes with its 5 to 6 per cent credit losses? How will this change the pre-eminent position that microcredit model had in terms of asset quality?

Muhammad Yunus: Microcredit programmes must learn to survive under all disaster situations. Giving up is not an option. One has to be innovative. Complaining about one thing or another for causing failure will not get microcredit anywhere.

Q4: Finally, in terms of the social enterprise ventures, which type of investors other than the government can be tapped for a pool of capital?

Muhammad Yunus: Creation of a whole new social business financial system is the answer. We should create social business microcredit banks, social business venture capital funds, investment funds, insurance funds and so on.

Yes, it is a good question to ask, who is going to invest in these companies if investors are not receiving any dividends?

To begin with, investors would be people who want to create foundations and trusts, who may see this as a better option. They may create a social business venture capital fund to transform unemployed youth into entrepreneurs or create a social business microcredit bank to lend money to poor women, and so on. They don’t do it now because this option is not available to them.

The plain and simple answer is, social business will exist and expand because people want them to. If people don’t want them, social business doesn’t have a future. If social business can prove that social business brings solutions, then it’s future is guaranteed. Social business is an option, if it brings the outcome people are looking for, it will have a future.

I promote the idea because I think people will be persuaded by its results. But they don’t have the opportunity to do it now, because our institutional framework never presented this option to them. If we keep on doing it, it will grow. I am confident that it addresses an unmet desire that exists in people’s minds and hearts.

Charity money accounts for trillions of dollars in the world. If a fraction of the charity money could be directed to social business as an investment or a loan, social businesses will be flooded with money.

Yes, governments can invest in social businesses if they think it is a better use of the public money. Governments can outsource many of their activities to social businesses. Governments will choose social business options for the same reason that people will choose the social business option. When they’ll look for solutions, not profit, they’ll opt for social business.

It is not uncommon to see profit-making businesses creating their own foundations. They set aside CSR money to donate. Now they’ll have another option— they can create their social businesses instead of or in addition to, creating foundations, and can invest their CSR money in social businesses.

Social businesses can mobilize loans from the market at usual terms and conditions. Just because my business is a social business doesn’t mean I cannot borrow from the market. If I am running a social business, it doesn’t mean I cannot do business with a profit making business. I can buy services from them, buy their products, sell my products to them, and do all kinds of business with them. The only thing is, I make sure my business remains dedicated to solving a defined problem, and I, the owner, do not take any profit from my business.

The more we discuss about social business the more interest it’ll generate for experimentation with it. If these experiments bring up positive results, social businesses will be on their way to lead the way to the future.

End

Related

15th Social Business Day 2025 to be held on June 27–28

Statement from Professor Muhammad Yunus:

দেশবাসীর উদ্দেশ্যে প্রফেসর ইউনূসের বক্তব্য

Prof. Muhammad Yunus felicitated in Manila on the occasion of his 40th anniversary of receiving the “Ramon Magsaysay” Award.

“র্যামন ম্যাগসাইসাই” পুরস্কার প্রাপ্তির ৪০তম বার্ষিকী উপলক্ষে প্রফেসর মুহাম্মদ ইউনূসকে ম্যানিলায় সম্মাননা প্রদান

Social Business Academia Dialogue & 3ZERO Club Convention 2024 held in Manila, Philippines

The 14th Social Business Day concludes in Manila, Philippines

The 14th Social Business Day 2024 kicks off in Manila, Philippines